Statement on Chicago, Illinois

June 8, 2015

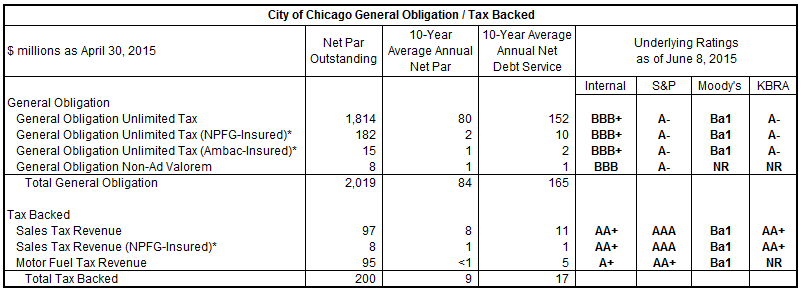

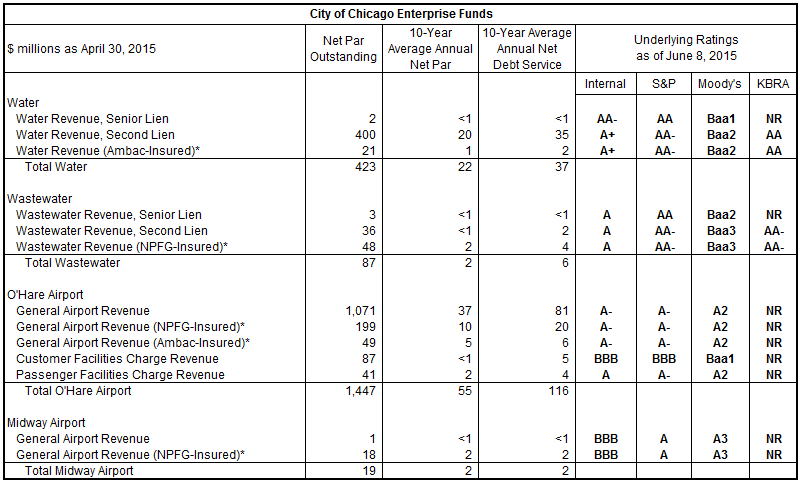

Assured Guaranty insurance and reinsurance is in force on various bonds, supported by a number of distinct revenue streams, related to the City of Chicago. The bonds include general obligation and tax-backed bonds, water and wastewater revenue bonds, and airport and airport facility charge bonds. In a number of cases, Assured Guaranty would have liability only if another insurance company failed to pay its obligation, as we wrapped certain bonds that carry insurance from other bond insurers. The table below details our exposure to the City of Chicago. All of the bonds listed are presently current as to their debt service payments. Additionally, holders of Chicago-related bonds insured by Assured Guaranty are currently benefiting from their bonds’ relative price stability compared with similar uninsured Chicago-related obligations.

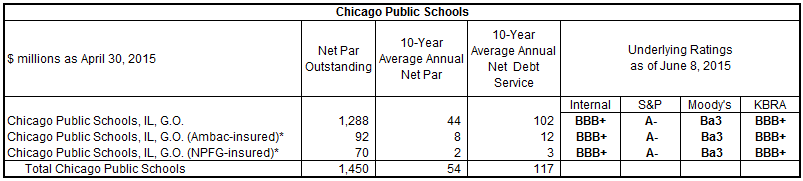

Chicago Public Schools

Assured Guaranty also has exposure to Chicago's public school district. The City of Chicago is not financially responsible for these school district obligations. In a number of cases, Assured Guaranty would have liability only if another insurance company failed to pay its obligation, as we wrapped certain bonds that carry insurance from other bond insurers. The table below details our exposure to Chicago's public school district. All of the bonds listed are presently current as to their debt service payments.

NR = no published rating. The tables above include, where applicable, the related exposures from the Radian Asset Assurance Inc. insured portfolio acquired in connection with Assured Guaranty’s purchase of that insurer on April 1, 2015.

* “NPFG-Insured” and “Ambac-Insured” indicate bonds where either National Public Finance Guarantee Corporation or Ambac Assurance Corporation first has the obligation to pay on its respective insurance policy, and therefore Assured Guaranty would be required to make a claim payment only in the case of a default by the applicable insurer following a default by the underlying obligor.