No Action Required of Assured Guaranty Policyholders to Be Protected from Potential Puerto Rico Defaults

June 29, 2017

When an issuer fails to make all or a portion of any debt service payment on bonds insured by Assured Guaranty, bondholders will continue to receive uninterrupted full and timely payments of scheduled principal and interest in accordance with the terms of Assured Guaranty’s insurance policies. No action is required on the part of investors to receive their scheduled debt service payments, as the relevant bond trustee, paying agent or, in the case of secondary market policies, custodian files the claim with Assured Guaranty on behalf of the bondholders. Once Assured Guaranty receives a claim from a bond trustee, paying agent or custodian, Assured Guaranty makes the claim payment directly to that party, which then distributes the funds to investor accounts in the same manner as when paid by the issuer. Under its standard municipal bond insurance policy, Assured Guaranty makes its payment no later than one business day after a claim is received, but not before the payment due date.

Within the Assured Guaranty group, only Assured Guaranty Municipal Corp. (AGM) and Assured Guaranty Corp. (AGC) have direct insured exposure to Puerto Rico or its instrumentalities. Assured Guaranty’s subsidiary Municipal Assurance Corp. (MAC) has no insured exposure to Puerto Rico.

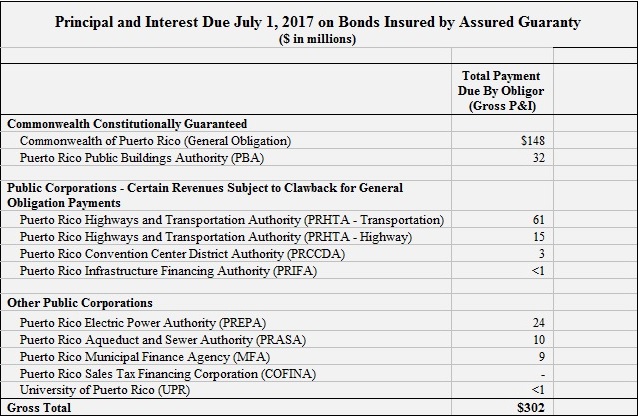

The following table shows the debt service amounts due on July 1 for Puerto Rico-related bonds insured by Assured Guaranty. The amounts of insurance claims, if any, are not yet known and will be disclosed subsequent to any insurance payments.

With $12 billion in claims-paying resources* and approximately $400 million generated each year from its $11 billion investment portfolio alone, Assured Guaranty’s liquidity and capital position are very strong. This is further evidenced by looking at S&P Global Ratings’ capital model, where the company estimates that its excess capital was more than $2.8 billion above S&P’s AAA requirement as of year-end 2016.

* Aggregate data for operating subsidiaries within the Assured Guaranty Ltd. group. Claims on each subsidiary’s insurance policies/guarantees are paid from that subsidiary’s separate claims-paying resources. Details of the components of claims-paying resources are set forth in the most recent Assured Guaranty Ltd. Financial Supplement.

The information set out above contains forward-looking statements that reflect Assured Guaranty’s current views with respect to future events and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve risks and uncertainties that may cause actual results to differ materially from those set forth in these statements. These risks and uncertainties include, but are not limited to, those resulting from Assured Guaranty's inability to execute its strategies, including its loss mitigation and risk remediation strategies, and negative developments that may impact Assured Guaranty's liquidity and capital, and therefore its ability to make claim payments on time and in full, including less demand for Assured Guaranty's financial guaranty product, or adverse developments with respect to its insured or investment portfolio, and other risks and uncertainties that have not been identified at this time, management's response to these factors, and other risk factors identified in Assured Guaranty’s filings with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which are made as of June 29, 2017. Assured Guaranty undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.