Assured Guaranty Protects Insured Bondholders from Puerto Rico Defaults: No Action Required of Assured Guaranty Bondholders

January 6, 2022

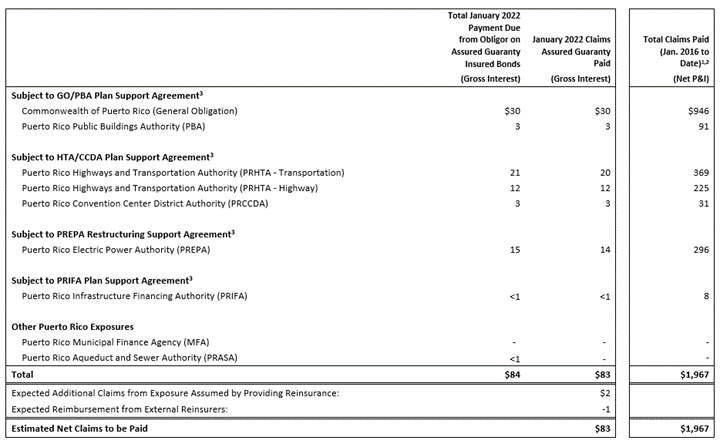

Two bond insurance subsidiaries of Assured Guaranty Ltd. (NYSE: AGO) (together with its subsidiaries, Assured Guaranty) made claim payments to holders of insured general obligation and other bonds on which Puerto Rico and certain of its instrumentalities defaulted on January 1, 2022. The table below lists the defaulting issuers, the total payments due January 1, 2022 from such issuers on bonds insured by Assured Guaranty Municipal Corp. (AGM) and Assured Guaranty Corp. (AGC), and the total gross and net claim payments made by Assured Guaranty.

As always, investors owning Puerto Rico-related bonds insured by Assured Guaranty continue to receive uninterrupted full and timely payment of scheduled principal and interest in accordance with the terms of Assured Guaranty’s insurance policies.

No action is required on the part of investors in bonds insured by Assured Guaranty to receive their scheduled debt service payments, as the relevant bond trustee, paying agent or, in the case of secondary market policies, custodian files the claim with Assured Guaranty on behalf of the bondholders. Upon receipt of a claim from a bond trustee, paying agent or custodian, Assured Guaranty makes the claim payment directly to that party, which then distributes the funds to investor accounts in the same manner as when paid by the issuer. Under its standard municipal bond insurance policy, Assured Guaranty makes the claim payment no later than one business day after a claim is received, but not before the payment due date.

The following table shows the amounts due on January 1, 2022 and related claims paid, as well as cumulative claims paid or expected to be paid since January 2016 for Puerto Rico-related bonds currently insured by Assured Guaranty

1) Includes amounts that have not yet been paid but are expected to be paid for assumed exposure for January 1, 2022 debt service payments.

2) Excludes net principal and interest claims totaling $299 million paid on bonds issued by the Puerto Rico Sales Tax Financing Corporation (“COFINA”).In February 2019, pursuant to a court-approved COFINA plan of adjustment (the Plan), the Company paid off in full the COFINA bonds it insured. Pursuant to the Plan, the Company received $152 million in initial par of new court-validated COFINA bonds, along with cash, which represented a total recovery of 60% of the Company’s official pre-petition claim under the related proceeding under Title III of the Puerto Rico Oversight, Management and Economic Stability Act. The Company sold all of those new COFINA bonds during the third quarter of 2019.

3) The Support Agreements, including the GO/PBA plan support agreement (PSA), the PREPA RSA, the HTA/CCDA PSA, and the PRIFA PSA, are described in Quarterly Report on Form 10Q for the quarterly period ended September 30, 2021, Part 1, Financial Information, Item 1, Financial Statements, Note 3, Outstanding Exposure.

As of the date of this statement, Assured Guaranty had been notified of $83 million of interest payment defaults on Puerto Rico exposures it insures. All claim notices received have been processed in full and payment made. For any obligors where the obligor owed a payment and Assured Guaranty paid no claims or paid only partial claims, the payments or balance of payments were made by the obligor, or from the obligor’s available reserves, or by the primary insurer.

The information set out above contains forward-looking statements that reflect Assured Guaranty’s current views with respect to future events and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such statements involve risks and uncertainties that may cause actual results to differ materially from those set forth in these statements. These risks and uncertainties include, but are not limited to, those resulting from the development, course and duration of the COVID-19 pandemic and the governmental and private actions taken in response, the effectiveness, acceptance and distribution of COVID-19 vaccines and medicines, and the global consequences of the pandemic and such actions; Assured Guaranty's inability to execute its strategies, including its loss mitigation and risk remediation strategies, including as a result of the failure to resolve Assured Guaranty's Puerto Rico exposure in a manner substantially consistent with the support agreements signed to date; and negative developments that may impact Assured Guaranty's liquidity and capital, and therefore its ability to make claim payments on time and in full, including less demand for Assured Guaranty's financial guaranty product, or adverse developments with respect to its insured or investment portfolio; and other risks and uncertainties that have not been identified at this time, management's response to these factors, and other risk factors identified in Assured Guaranty’s filings with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which are made as of January 6, 2022. Assured Guaranty undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.