Climate Risk Management

Insured Portfolio

Assured Guaranty’s established risk management framework focuses on identifying, measuring, managing and internally reporting credit risks, as well as other enterprise risks, including, but not limited to, market, financial, investment, liquidity, legal, operational, and reputational risks and, more recently, climate related risks. We have integrated the financial impact of climate risk into our broad existing risk management framework and processes, rather than isolating or “siloing” climate risk as a stand-alone issue to be considered independently and outside of our general risk management framework.

Our Company has long considered environmental impacts as part of our underwriting process, in particular with regard to U.S. public finance transactions. Global awareness of changing climate conditions has drawn greater attention to the financial implications and long-term consequences of frequent or severe natural disaster perils (e.g., storms and wildfires). Our Company does not have direct insurance exposure to natural perils, however, as a financial guarantor of municipal and structured finance transactions, it does face the risk that an obligor’s ability to pay debt service may be impacted as a result of such perils and the exacerbating effect extreme weather or deteriorating climatic conditions may have on their operations and/or financial condition.

We continue to enhance our approach to the consideration of climate risk in the origination, underwriting, credit approval, and surveillance of our insured exposures and have integrated climate risk into our risk management and control functions. Credit underwriting submissions are required to include an assessment of environmental and/or transitional risk factors as part of the underwriting analysis. Specifically, the vulnerability of obligors is evaluated with respect to climatic changes (e.g., sea level rise, droughts), extreme weather events (e.g., hurricanes, tornadoes, floods) or geological events (e.g., earthquakes, volcanic activity) as well as resilience factors (e.g., mitigation capabilities, adaptation capacity) to determine if such environmental issues could materially impact an obligor’s expected performance.

Our assessment of how climate risks may impact a prospective obligor’s ability to pay debt service is informed by our extensive experience in municipal finance coupled with proprietary analytics and third-party data and insights. To improve our understanding of changing climatic conditions and to develop the analytical tools needed to measure and manage the related financial risks, we have been investing in both talent and technology. Our risk management resources include climate science expertise. In addition, a dedicated internal team works with a data analytics company specializing in climate risk analysis and the impact of extreme weather events on cities, counties, and states to develop analytical capabilities to evaluate climate risk and assess potential negative impacts that climate change could have on the proposed obligor’s ability to pay debt service.

Risk management begins at the top of our organization and is integrated throughout levels of management and incorporated into our Company’s policies, processes, and practices.

Board Oversight: The Environmental and Social Responsibility Committee and the Risk Oversight Committee of Assured Guaranty Limited’s Board of Directors provide oversight of our Company's approach to addressing climate risk in accordance with their respective charters. The Environmental and Social Responsibility Committee reviews updates on the consideration of environmental risks in our insurance risk management and investment portfolio, as well as legislative and regulatory developments of significance to the Company’s environmental initiatives and related oversight. The Risk Oversight Committee reviews the establishment and implementation of enterprise risk management policies and practices, including credit risk and the potential impact of climate change on the Company’s portfolio of insured transactions.

Senior Management Leadership: Our Company has a network of management committees that establish and guide the execution across Assured Guaranty of our risk management philosophy, strategy, and culture, including with respect to climate risk. These committees are comprised of senior management members from across the organization who are responsible for the origination, underwriting, credit, surveillance, legal, risk management and actuarial functions of our Company. These senior management committees are the key decision-making bodies for our Company.

The cross-functional membership of these committees provides a forum for our senior management to collaborate and coordinate on our Company’s objectives and align risk appetite with business strategy, including the identification, assessment, and management of environmental issues.

We have also formed an environmental risk working group composed of senior members of the credit, underwriting, surveillance, and risk management departments, to review the impact of environmental risk on our Company, including the development of objective risk measures, metrics and methodologies needed to evaluate the financial impact of evolving climatic conditions and extreme weather events on obligors in its insured portfolio on both an aggregate and individual basis.

The Chief Risk Officer at either the subsidiary or group levels for each operating company is designated as the board member and member of senior management responsible for overseeing the management of climate risks.

Investment Portfolio

In addition to traditional quantitative metrics, qualitative factors such as good governance practices and proper oversight, transparent reporting and disclosure, exposure to litigation and regulation, changes in supply or demand characteristics of fuels, technological development, sustainability, vulnerability to climate risks (physical and transition) and exposure to extreme weather events, human capital management and stewardship, corporate culture and reputation can also have an effect on asset value and performance. As a prudent investor, Assured Guaranty understands the importance of fundamental research and careful consideration of relevant risk factors, both quantitative and qualitative, that impact performance and return expectations.

Our investment portfolio holds predominantly fixed-income assets; therefore, its primary risks are credit-related. Material qualitative factors play a role in the evaluation by us or our external investment managers of the creditworthiness of specific issuers and industries. Our investment managers rely on their respective corporate investment philosophy statements and use information regarding sustainability and responsible business practices, along with a variety of other economic factors, including risk and valuation metrics, when conducting research and due diligence on new investments, and again when monitoring investments for Assured Guaranty’s investment portfolio. On an annual basis, the Company requests and reviews reports from its primary investment managers on any material qualitative factors that may adversely impact returns.

In addition, we have determined not to make any new investments in thermal coal enterprises in Assured Guaranty’s investment portfolio. As a consequence, we will refrain from making any new investments in (i) thermal coal enterprises that generate 30% or more of their revenue from either the ownership, exploration, mining, or refining of thermal coal, and (ii) corporate and municipally owned utilities that generate 30% or more of their electricity from thermal coal.

Environmental Stewardship

Assured Guaranty is committed to understanding, managing and mitigating the risks to our business associated with environmental issues and to operating our business in an environmentally responsible manner.

As a financial services firm with approximately 365 employees, the direct impact of our operations on the environment is relatively small, but we have a role and a responsibility to manage our operations in ways that reflect our respect for the environment. Our Policy on Climate Risk Management and Environmental Stewardship guides our actions and strategies in four critical areas:

• Insurance Risk Management and Strategic Opportunities

• Investment Opportunities

• Business Operations and Facilities Management

• Employee Engagement

Corporate Offices

Since 2016, approximately 95% of our employees have been working in buildings which are U.S. Green Building Council’s LEED or U.K, BREEAM certified.

1633 Broadway, New York, NY

Our office at 1633 Broadway in Manhattan is rated a Gold LEED building, a top environmentally green rating. LEED certified buildings strive to save resources and have a positive impact on the health of occupants. The building is also ENERGY STAR rated. ENERGY STAR is a joint program of the U.S. Environmental Protection Agency and the U.S. Department of Energy protecting the environment through energy efficient products and practices. On average, ENERGY STAR certified commercial buildings use 35% less energy than typical similar buildings nationwide.

150 California Street, San Francisco, CA

Our San Francisco office is located in a building that has a Gold LEED level of certification and is also ENERGY STAR rated.

6 Bevis Marks, London, UK

Our London office is in a building with an “Excellent” BREEAM (Building Research Establishment Environmental Assessment Method) rating.

Efforts to Reduce and Recycle

Assured Guaranty leverages technology to reduce our carbon footprint, through such measures as deploying motion sensors and LED lights to reduce electricity usage; reducing paper usage through use of digital platforms and portable devices; and video conferencing capabilities to help limit travel.

We also seek other ways to reduce our carbon footprint and our use of natural resources. To reduce paper and energy use we have adopted several changes over the past few years. We default our large printers to two-sided printing and implemented secure printing, only printing jobs when they are retrieved by the employee. We also distribute board materials through electronic media. As another example of digital distribution, we send our annual holiday cards electronically, eliminating the environmental impact of producing and mailing physical cards. We donate our avoided costs to selected charities nominated by our employees.

We have taken advantage of the Securities and Exchange Commission’s Notice and Access initiative to significantly reduce the number of Annual Reports and Proxy Statements we print and mail each year. By mailing only a simple notice to shareholders and making the full documents available online, we now produce only enough printed copies to meet the demand of those who request them, reducing both paper usage and the energy usage of printing and mailing thousands of bound books. To reduce the use of single-use plastic water bottles we added more filtered water and seltzer dispensers, encouraging employees to use reusable water bottles. We also make reusable mugs available to our employees to reduce our usage of disposable cups. In our New York office, we periodically measure our savings associated with reducing our overall consumption of disposable cups and donate the money to an organization that works to restore and/or preserve the environment.

Throughout our enterprise, we derived 100% of our electricity from the grid. We used publicly available data to estimate the amount and proportion of our energy and electricity usage that derived from renewable (solar, wind, geothermal, hydro, biomass) and non-renewable sources.

| Sources | 2023 | |

| Usage | % Renewable* | |

| Electricity | 4118.6 MWh | 29.0% |

| Natural Gas | 63397.3 Therms | --- |

* Sources: Environmental Protection Agency Power Profiler; Association of Issuing Bodies European Residual Mixes; Bermuda Regulatory Authority Bermuda Integrated Resource Plan

As a financial services firm, we do not create hazardous waste in our ordinary course of business operations. However, we generate hazardous waste through the disposal of IT equipment. We dispose of our E-waste in compliance with ethical recycling standards for all IT equipment by using a vendor for electronic waste disposal that complies with the e-Stewards Initiative. The e-Stewards Initiative defines and promotes responsible electronics reuse and recycling best practices worldwide.

Employee Engagement and Awareness

Our employees are a valuable resource and critical ally in furthering our environmental objectives. We help our employees become more aware of their individual impact on the environment, the importance of making environmentally conscious choices, and the availability of sustainable alternatives.

- We encourage our employees to use resources such as energy, paper, and water more responsibly

- We make it easy for our employees to recycle by providing paper-only recycling bins at each employees’ workstation as well as placing ample separate paper and plastic/bottle recycling bins throughout the office common areas

- We support our employees in reducing their environmental impact by offering mass transit incentives for commuting and green cars for corporate travel

- Most importantly, we solicit suggestions from our employees, who know our business the best, for more environmentally responsible ways of conducting our operations. Protecting the environment is a shared responsibility.

We are encouraged by the accomplishments we have made thus far and intend to continue to do our part.

Managing Greenhouse Gas Emissions

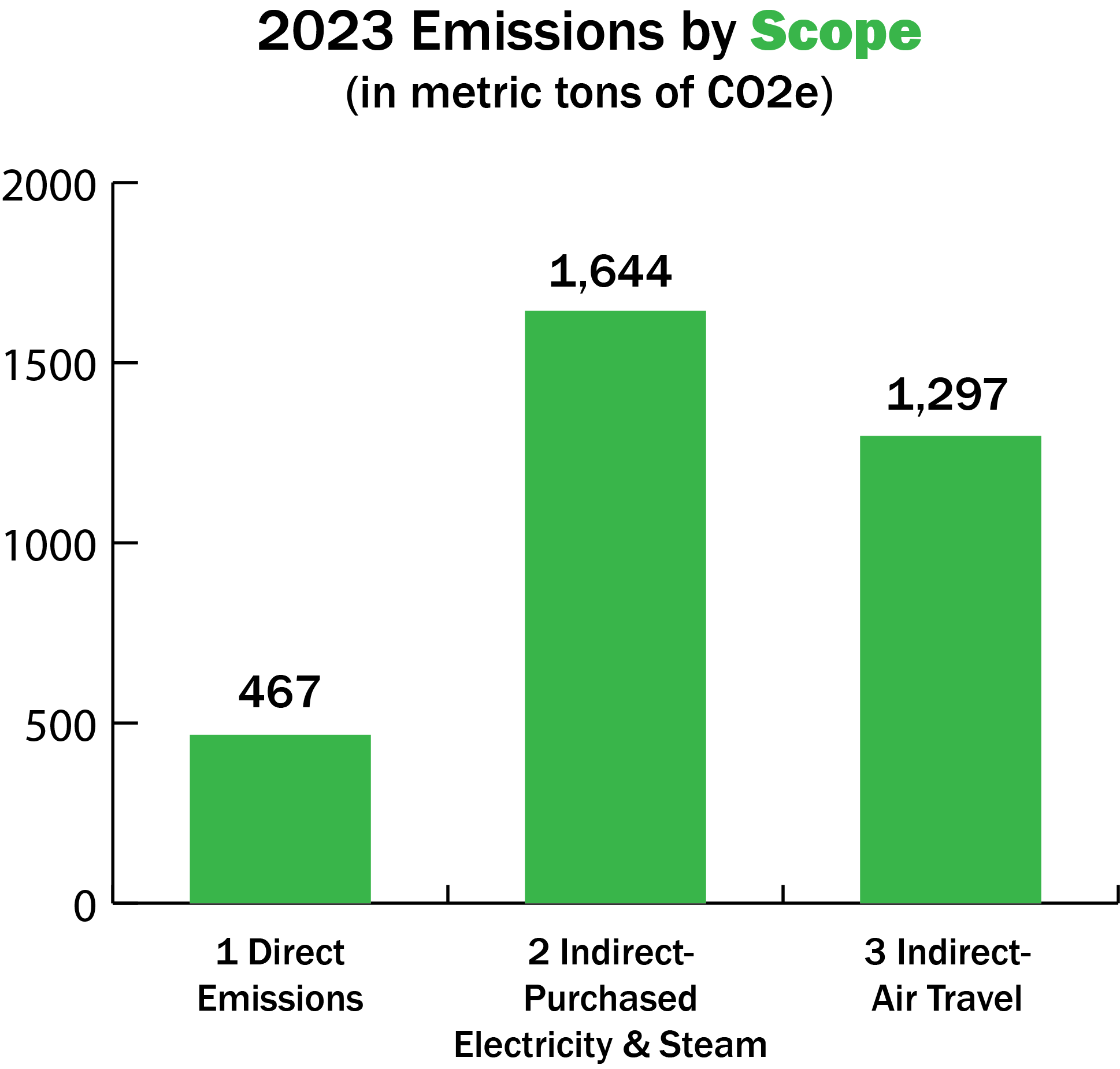

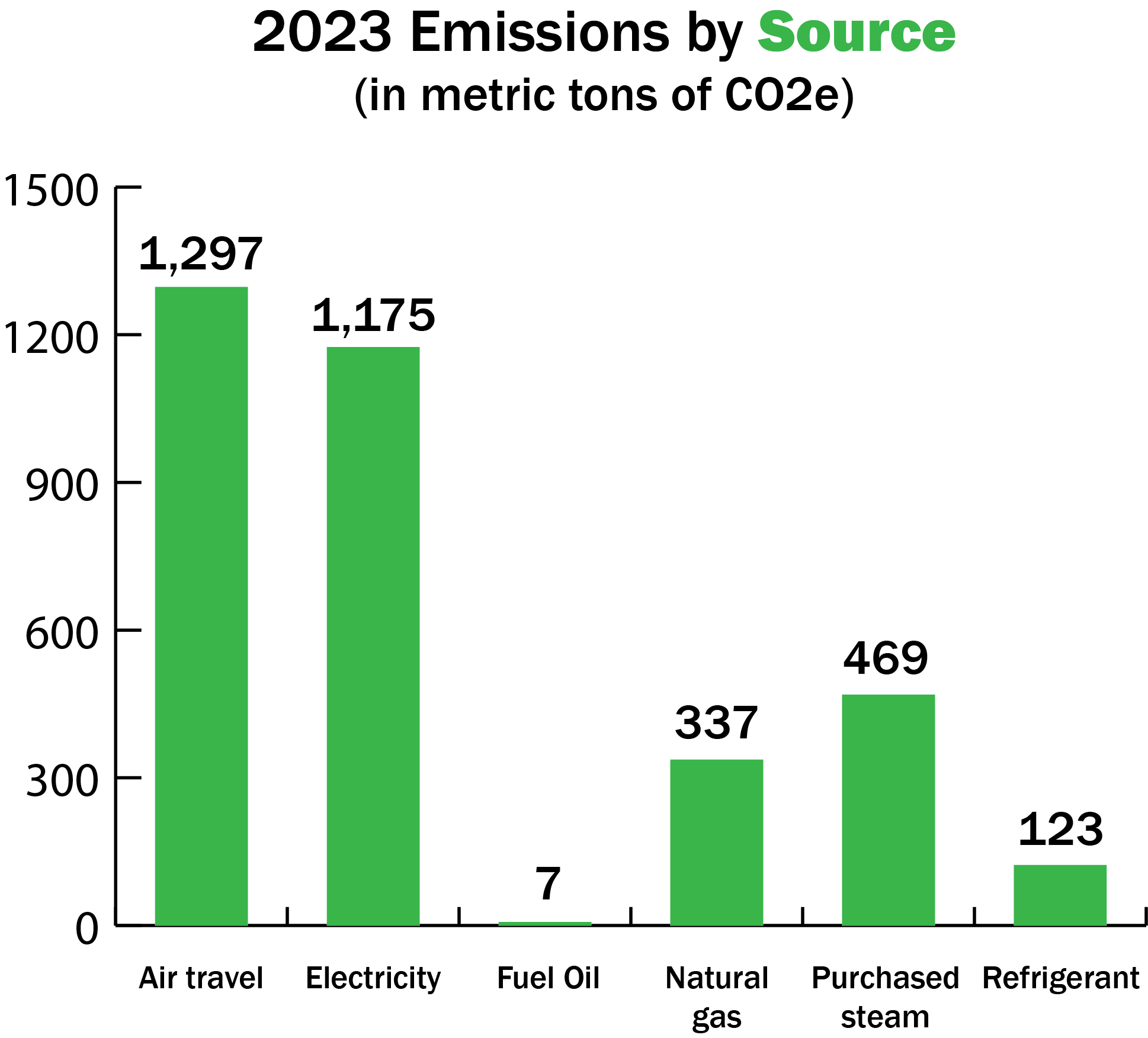

Beginning in 2019, we instituted a program to measure, manage and report our GHG emissions on an enterprise-wide basis. Pursuant to the Greenhouse Gas Protocol, we conduct internal data collection and analysis annually for our Scope 1, Scope 2 and select Scope 3 GHG emissions (air travel). Our methodology and results are independently reviewed and verified. In accordance with the GHG Protocol, Scope 2 – Indirect Purchased Electricity includes electricity and steam service purchased from our utilities.

The tables below show estimated enterprise-wide emissions by scope and by source of emissions, which were independently reviewed by a third-party engineering consulting firm, in accordance with the ISO 14064-3 International Standard.

Note: Scope 3 emissions 3 is comprised of corporate air travel.

In addition to total emissions as categorized above, we calculate our emissions intensity per employee and adjusted operating income to permit comparison with other organizations.

| GHG Emission Intensity | Scope 1 | Scope 2 | Scope 3 | Total mt CO2e | Employees* | Total Per Employee | Net Income (million USD) | Total Per Million USD income |

| 2023 | 467 | 1,644 | 1,297 | 3,407 | 350 | 9.74 | 648 | 5.26 |

* Employee data is as of December 31, 2023.